In business, it is important for the marketing and sales team to understand their target audience. However, knowing how your customers like to be interacted with can really improve the customer service experience. If your consumers don’t enjoy consistent follow ups, you’ll want to make sure you are doing so in the best way for your business.

Each year RingPartner receives millions of inbound consumer calls providing unique insight into their behaviors and buying patterns. We are able to analyze these calls and come up with data to help businesses better understand their audience allowing them to optimize their businesses to drive high quality leads.

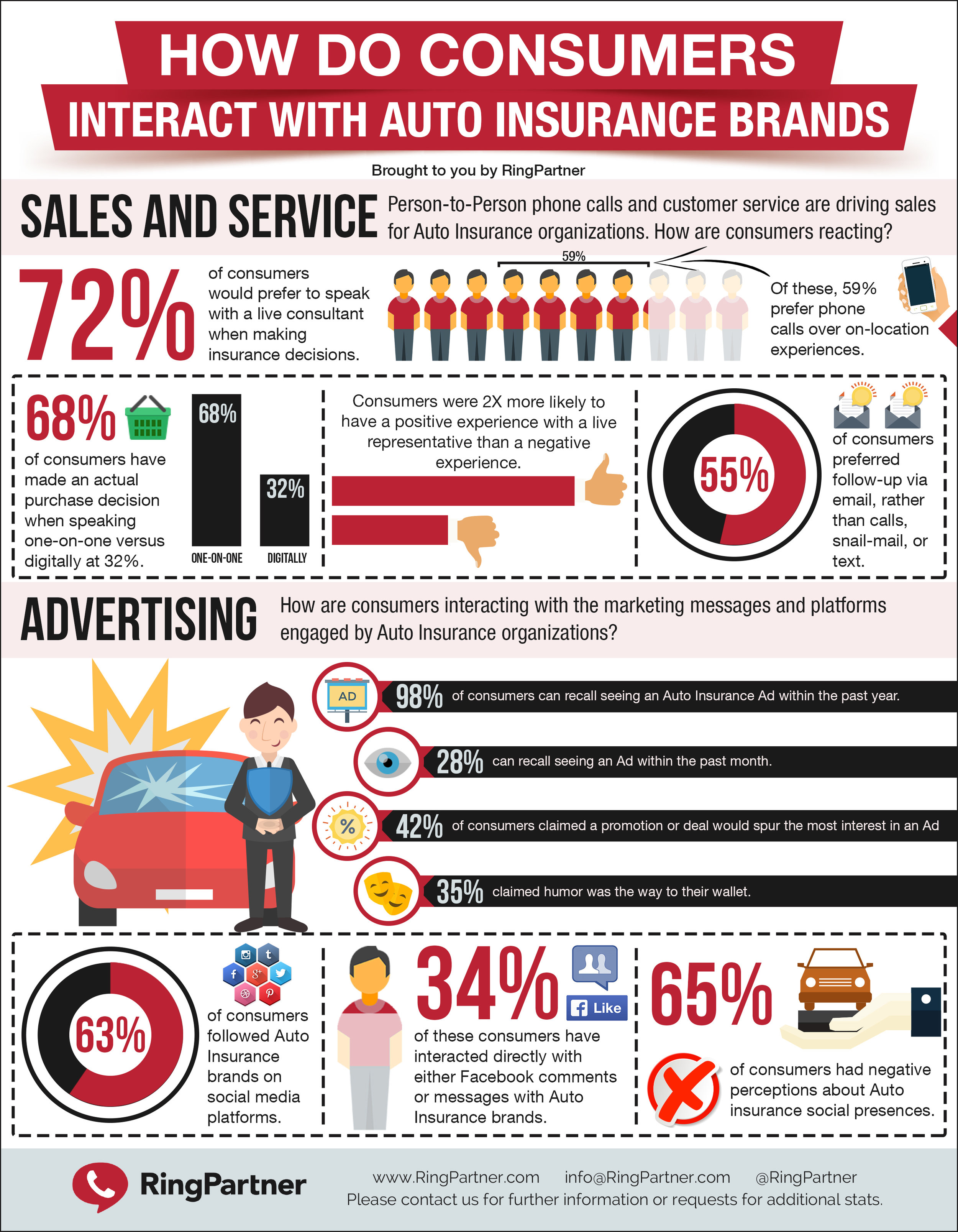

From looking at big data and conducting surveys, RingPartner analyzed inbound calls in Auto Insurance to better understand their consumers. With Auto Insurance brands, 72% of people prefer to speak to a live consultant when making decisions and 59% prefer calls over on-location experiences. People find it’s much easier to talk out prices, and deals on the phone or in-person compared to an online experience. In fact, 68% of consumers have made purchasing decisions when speaking one-on-one compared to 32% who have made purchasing decisions digitally. With the statistics showing how an actual conversation converts 2x more compared to a digital conversation, knowing the power of a phone call can really drive your leads to convert.

With RingPartner’s unique insight gathered from big data in Pay Per Call, it’s easy to see the opportunity Pay Per Call has to offer for Auto Insurance brands.